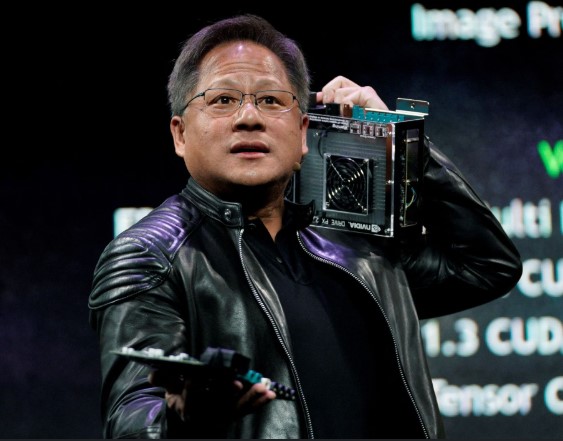

The global technology industry is facing its biggest geopolitical earthquake in decades. In a shocking revelation that underscores the deepening tech cold war, Nvidia CEO Jensen Huang has confirmed the unthinkable: the company’s dominant position in China’s AI chip market has completely evaporated.

From an overwhelming 95% market share to absolute zero – this dramatic collapse represents one of the most significant market shifts in semiconductor history. The numbers tell a story of how geopolitical tensions are reshaping global technology supply chains and creating winners and losers in the artificial intelligence race.

This exclusive deep dive explores every aspect of this seismic shift. We’ll examine the timeline of events that led to this point, the billion-dollar financial implications for Nvidia, the unexpected beneficiaries of this vacuum, and what the future holds for global AI development.

The Great Wall of Silicon: Understanding Nvidia’s China Collapse

The Moment of Truth: Huang’s Stark Admission

The revelation came during a candid interview at Citadel Securities’ Future of Global Markets 2025 event in New York. In what marked Nvidia’s first public quantification of its China retreat, Huang didn’t sugarcoat the reality.

“At the moment, we are 100% out of China,” Huang stated, delivering the punchline that would echo across global markets: “We went from 95% market share to 0%.”

The significance of this statement cannot be overstated. For years, Nvidia had enjoyed near-total dominance in China’s AI accelerator market – the very chips that power everything from cloud computing to advanced machine learning applications.

The Regulatory Timeline: How We Got Here

This collapse didn’t happen overnight. It was the result of a carefully orchestrated series of regulatory moves by the US government:

Phase 1: Initial Restrictions (October 2022)

- First wave of US export controls on advanced semiconductors

- Targeted cutting-edge AI chips with specific performance thresholds

- Aimed at limiting China’s access to military-grade AI technology

Phase 2: Nvidia’s Adaptation Strategy

- Company created China-specific A800 and H800 chips

- These were technically compliant but still powerful alternatives

- Maintained market presence while adhering to letter of regulations

Phase 3: The Closure (2023-2024)

- US government tightened performance thresholds

- Closed loopholes that allowed modified chips

- Rendered Nvidia’s China-specific products non-compliant

- Latest H20 chip faced insurmountable licensing hurdles

The pattern is clear: what began as targeted restrictions evolved into a comprehensive blockade of advanced AI chip exports to China.

The Billion-Dollar Question: Analyzing the Financial Impact

Revenue Reality Check

The numbers behind Nvidia’s China business reveal why this collapse matters financially. Prior to the restrictions, China represented:

- 20-25% of Nvidia’s data center revenue

- $8-10 billion in annual revenue

- One of the company’s fastest-growing markets

Context matters: Nvidia’s data center segment generated over $41 billion in its most recent fiscal year, growing 56% year-over-year. Losing a quarter of this growth engine represents a significant strategic challenge.

The Stock Market Reaction

Wall Street’s response has been nuanced. While Nvidia stock initially dipped on China concerns, the company’s continued dominance in other markets and relentless innovation have maintained investor confidence. The market capitalization continues to hover around the $4 trillion mark, demonstrating that investors see growth opportunities beyond China.

The Ripple Effect: How China is Adapting

The Rise of Domestic Champions

Nature abhors a vacuum, and so do technology markets. With Nvidia out of the picture, Chinese tech giants have accelerated their pivot to domestic solutions:

Huawei’s Ascend Chips

- Now the primary beneficiary of Nvidia’s exit

- Significant performance improvements in recent generations

- Gaining rapid adoption among Chinese cloud providers

Other Domestic Players

- Alibaba’s Pingtouge semiconductor division

- Tencent’s investments in AI chip startups

- Baidu’s Kunlun chips gaining traction

The Ecosystem Shift

It’s not just about replacing hardware. China is building an entire alternative AI ecosystem:

- Software Frameworks: Adapting to work with domestic chips

- Development Tools: Creating alternatives to Nvidia’s CUDA platform

- Cloud Infrastructure: Retooling data centers for Chinese semiconductors

This represents exactly what Huang warned about: the creation of a parallel, competitive ecosystem that may eventually challenge US technological leadership.

The Man in the Arena: Jensen Huang’s Leadership Challenge

Navigating Geopolitical Storms

Huang’s comments reveal the delicate balancing act required of modern tech CEOs:

“I can’t imagine any policymaker thinking that’s a good idea, that whatever policy we implemented caused America to lose one of the largest markets in the world to 0%.”

This statement reflects the frustration of a business leader watching market access evaporate due to factors beyond his control. Yet Huang has been pragmatic in his response, immediately shifting focus to other growth markets.

The Forward-Looking Strategy

Nvidia’s current approach can be summarized in Huang’s own words: “In all of our forecasts… we’re assuming 0% for China. If anything happens in China… it will be a bonus.”

This reveals several strategic priorities:

- Diversification: Accelerating growth in other regions

- Innovation: Maintaining technological leadership

- Efficiency: Optimizing operations for the new reality

- Advocacy: Continuing dialogue with policymakers

Global Implications: The AI Chip Market Fractures

The Bifurcation of Technology

We’re witnessing the emergence of two distinct AI technology stacks:

US-Led Ecosystem

- Nvidia GPUs as the gold standard

- Google TPUs and other specialized AI chips

- Advanced manufacturing in Taiwan and South Korea

China-Led Ecosystem

- Huawei Ascend chips as the new benchmark

- Multiple domestic semiconductor manufacturers

- Increasing self-sufficiency across the supply chain

The Innovation Dilemma

This bifurcation creates fundamental questions about future AI development:

- Will different standards emerge?

- How will global research collaboration be affected?

- What happens to the pace of innovation when resources are duplicated?

Beyond China: Nvidia’s Global Growth Engines

Other Asian Markets

- Japan and South Korea: Heavy investment in AI infrastructure

- India: Emerging as a major AI development hub

- Southeast Asia: Rapid digital transformation driving demand

Middle East and Europe

- Saudi Arabia and UAE: Massive investments in AI infrastructure

- European Union: Catch-up efforts in AI capability

- United Kingdom: Focus on becoming AI research hub

North American Dominance

- US Cloud Giants: Continuing massive AI investments

- Canadian AI Research: World-leading academic institutions

- Mexican Manufacturing: Growing role in supply chain

The Human Element: Workforce and Cultural Impact

Nvidia’s Internal Shifts

The China situation has triggered significant internal realignment:

- R&D Focus: Redirecting resources to other markets

- Sales Structure: Reorganizing global teams

- Supply Chain: Adapting to new market realities

Industry-Wide Effects

The repercussions extend throughout the semiconductor ecosystem:

- Talent Wars: Intense competition for AI chip engineers

- Investment Patterns: Venture capital following new opportunities

- Academic Research: Shifting collaboration patterns

Looking Ahead: The Future of AI Chip Markets

Short-Term Projections (2025-2026)

- Continued growth in non-China markets

- Accelerated development of Chinese alternatives

- Ongoing geopolitical tensions

- Potential for further regulatory changes

Medium-Term Outlook (2027-2028)

- Possible emergence of credible Chinese competitors

- New architectural approaches to AI computing

- Evolving regulatory frameworks

- Potential market re-entry scenarios

Long-Term Considerations (2029+)

- Sustainability of parallel technology stacks

- Impact on global AI leadership

- Potential for technological reconvergence

- New market dynamics and competition

Conclusion: Navigating the New Normal

Nvidia’s experience in China represents a watershed moment for the global technology industry. The rules of engagement have fundamentally changed, and companies must adapt to a world where geopolitical considerations are as important as technological innovation.

For Nvidia, the path forward involves playing the hand they’ve been dealt with characteristic innovation and strategic clarity. The company’s ability to maintain its technological edge while navigating these complex waters will determine its position in the next chapter of the AI revolution.

The broader lesson for the tech industry is clear: in an increasingly fragmented world, flexibility, diversification, and political awareness are no longer optional – they’re essential survival skills.

One thing remains certain: as the AI revolution accelerates, the companies that can best navigate these complex crosscurrents of technology, politics, and markets will shape our collective future.

Frequently Asked Questions (FAQs)

1. Why did Nvidia lose its China market share?

Nvidia lost its China market share due to US government export controls that prevent the sale of advanced AI chips to Chinese companies. These restrictions were implemented for national security reasons.

2. What percentage of Nvidia’s revenue came from China?

Before the restrictions, China accounted for 20-25% of Nvidia’s data center revenue, representing approximately $8-10 billion annually.

3. Is Nvidia developing special chips for the Chinese market?

Nvidia had developed modified chips like the A800, H800, and H20 for China, but these were eventually restricted by updated US export controls.

4. How is China replacing Nvidia’s AI chips?

Chinese companies are turning to domestic alternatives like Huawei’s Ascend chips, as well as developing their own AI semiconductor ecosystems.

5. What impact will this have on Nvidia’s future growth?

While significant, Nvidia is compensating by focusing on growth in other regions including North America, Europe, Middle East, and other Asian markets.

6. Could Nvidia return to the Chinese market?

A return would require changes in US export policy. Currently, Nvidia is operating under the assumption of zero China revenue in its forecasts.

7. How are Chinese AI companies affected by this change?

Chinese companies face short-term challenges but are accelerating development of domestic alternatives, which could create long-term competition for Nvidia.

8. What other markets is Nvidia focusing on now?

Nvidia is seeing strong growth in cloud computing, automotive AI, healthcare applications, and enterprise AI solutions across global markets.

9. How has Nvidia’s stock price been affected?

While there was initial concern, Nvidia’s continued innovation and dominance in other markets has helped maintain strong investor confidence.

10. What does this mean for the global AI industry?

The situation is accelerating the bifurcation of the global AI industry into separate US-led and China-led technology ecosystems.

JioHotstar 2025 || Unlock Thrilling Streaming Power with Epic Plans, Live IPL, and AI Magic in India